Getting The Clark Wealth Partners To Work

Table of ContentsThe Clark Wealth Partners PDFs6 Easy Facts About Clark Wealth Partners DescribedThe 7-Second Trick For Clark Wealth PartnersThe 45-Second Trick For Clark Wealth PartnersThe 8-Minute Rule for Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.The Clark Wealth Partners Diaries

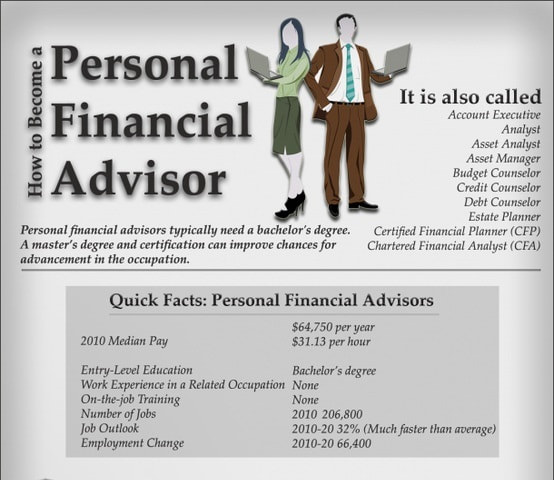

These are experts that give investment recommendations and are signed up with the SEC or their state's safety and securities regulatory authority. Financial advisors can also specialize, such as in student loans, senior needs, taxes, insurance coverage and other elements of your financial resources.Not constantly. Fiduciaries are legitimately required to act in their client's benefits and to maintain their cash and residential property different from other properties they take care of. Just economic consultants whose designation calls for a fiduciary dutylike licensed economic organizers, for instancecan claim the exact same. This distinction additionally suggests that fiduciary and economic advisor cost frameworks vary also.

Indicators on Clark Wealth Partners You Need To Know

If they are fee-only, they're more probable to be a fiduciary. If they're commission-only or fee-based (suggesting they're paid using a mix of charges and payments), they might not be. Numerous qualifications and classifications need a fiduciary responsibility. You can inspect to see if the expert is registered with the SEC.

Picking a fiduciary will certainly ensure you aren't steered towards certain investments due to the commission they use - financial company st louis. With great deals of money on the line, you may desire a financial professional who is lawfully bound to use those funds meticulously and just in your benefits. Non-fiduciaries may recommend investment products that are best for their pocketbooks and not your investing objectives

Not known Facts About Clark Wealth Partners

Boost in savings the typical house saw that worked with a monetary expert for 15 years or even more contrasted to a similar home without a financial advisor. "A lot more on the Value of Financial Advisors," CIRANO Task News 2020rp-04, CIRANO.

Financial guidance can be beneficial at transforming points in your life. When you meet with an adviser for the very first time, function out what you desire to obtain from the guidance.

The Greatest Guide To Clark Wealth Partners

As soon as you've agreed to go in advance, your monetary consultant will certainly prepare a monetary plan for you. You need to constantly feel comfy with your advisor and their guidance.

Firmly insist that you are alerted of all purchases, and that you obtain all document associated to the account. Your advisor may recommend a handled optional account (MDA) as a method of managing your investments. This includes signing an arrangement (MDA agreement) so they can buy or market investments without needing to check with you.

Not known Facts About Clark Wealth Partners

To secure your cash: Do not offer your adviser power of attorney. Firmly insist all document concerning your financial investments are sent out to you, not simply your advisor.

This might take place during the meeting or digitally. When you get in or restore the recurring charge plan with your adviser, they must define just how to end your relationship with them. If you're moving to a new advisor, you'll require to set up to transfer your economic records to them. If you require aid, ask your advisor to clarify the process.

To fill their footwear, the nation will certainly need even more see this than 100,000 brand-new monetary advisors to get in the sector.

What Does Clark Wealth Partners Do?

Assisting people achieve their monetary objectives is a financial advisor's main function. Yet they are additionally a small company owner, and a part of their time is devoted to handling their branch office. As the leader of their method, Edward Jones economic advisors need the management skills to work with and manage staff, as well as business acumen to develop and carry out an organization approach.

Spending is not a "collection it and forget it" task.

Financial experts need to set up time each week to meet new individuals and capture up with individuals in their ball. The monetary solutions sector is greatly regulated, and regulations transform commonly - https://www.intensedebate.com/profiles/jovialtotallyfc8f11b0da. Several independent economic consultants spend one to 2 hours a day on conformity tasks. Edward Jones monetary advisors are privileged the office does the heavy training for them.

Rumored Buzz on Clark Wealth Partners

Edward Jones monetary advisors are motivated to go after additional training to broaden their expertise and skills. It's likewise an excellent idea for financial advisors to attend sector conferences.